Stock sale tax calculator

Ad Achieve predictable profitable outcomes by putting our proven solutions to work. The calculator on this page is designed to help you estimate your.

Rsu Taxes Explained 4 Tax Strategies For 2022

Use Stock Tax Calculator to calculate your capital returns in 2022.

. 2021-2022 Capital Gains Tax Rates Calculator 6 days ago 2021 capital gains tax calculator. Sales Tax Calculator. Take the burden of sales tax compliance off your plate with help from Avalara AvaTax.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. 39 to 119. Enter the number of shares purchased.

Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. A calculator to quickly and easily determine the profit or loss from a sale on shares of stock. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

2022 capital gains tax rates. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on. Ad Browse discover thousands of brands.

All tax calculators tools. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. The Stock Calculator is very simple to use.

Short term gains on stock investments are taxed at your regular tax rate. The Stock Calculator is very simple to use. Find high-quality stock photos that you wont find anywhere else.

Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment. Read customer reviews find best sellers. Optimize your pricing strategy with real-time market analytics profit trends.

This Stock Tax Calculator can help you check your capital gains short-term gains long-term gains federal gains more. Great video footage that you wont find anywhere else. Search from Stock Sale Tax Calculator stock photos pictures and royalty-free images from iStock.

Add multiple results to a. Build Your Future With A Firm That Has 85 Years Of Investing Experience. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. 2021 capital gains tax calculator. Enter the purchase price per share the selling price per share.

Just follow the 5 easy steps below. For example if you sell stock A for a 10000 profit in 2022 be prepared to pay. NerdWallet users get 25 off federal and state filing costs.

The tax rate on short-term capital gains is your regular income tax rate. Choose from Stock Sale Tax Calculator stock illustrations from iStock. Taxes owed on capital gains are generally due for the tax year of the sale.

Sales tax is calculated by multiplying the. Find Stock Sale Tax Calculator stock video 4k footage and other HD footage from iStock. The tax rate you pay on long-term capital gains can be 0 15 or 20 depending.

Find high-quality royalty-free vector images that you wont find anywhere else. Finds the target price for a desired profit amount or percentage. Long term gains are taxed at 15 for most tax brackets and zero for the lowest two.

Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. At tax time TurboTax Premier will guide you through your investment transactions allow you to automatically import up to 10000 stock. Optimize your pricing strategy with real-time market analytics profit trends.

Ad Achieve predictable profitable outcomes by putting our proven solutions to work. For example if your regular tax rate is 25 percent the tax rate on a 390 short-term capital gain is. Check out our free Capital Gains Interactive Calculator that in just one screen will answer your burning questions about your stock sales and give you an estimate of how much.

The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37. Use this interactive tool to see how charitable giving can help you save on taxesand how accelerating your giving with the bunching strategy may help save even. All filers get access to Xpert Assist for free until April 7.

Tip Sales Tax Calculator Salecalc Com

3 Ways To Calculate Capital Gains Wikihow

Rsu Taxes Explained 4 Tax Strategies For 2022

Reverse Sales Tax Calculator 100 Free Calculators Io

Locating And Discovering Sales Tax Medical Icon Sales Tax Tax

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Calculator Tax Vat And Gst Apps On Google Play

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Capital Gains Yield Cgy Formula Calculation Example And Guide

How Capital Gains Affect Your Taxes H R Block

Rsu Taxes Explained 4 Tax Strategies For 2022

3 Ways To Calculate Capital Gains Wikihow

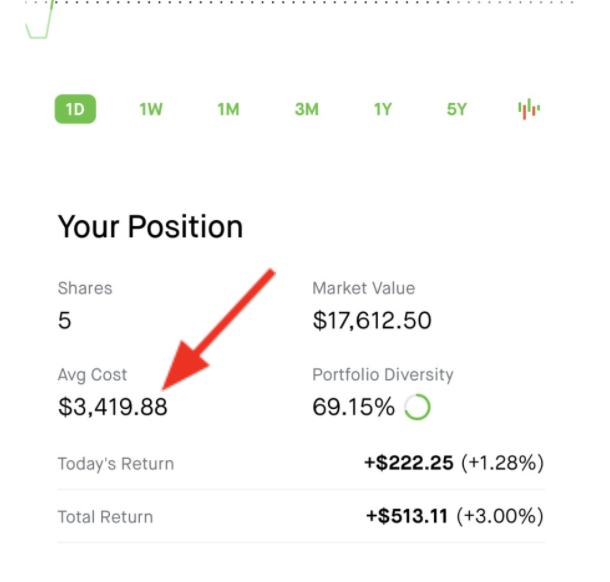

Average Cost Robinhood

Tax Calculator Estimate Your Income Tax For 2022 Free

Capital Gains Tax What Is It When Do You Pay It

2022 Capital Gains Tax Rates By State Smartasset

Effective Tax Rate Formula Calculator Excel Template